For Pablo Vial from Chile, LATAM Sales Manager at Haygrove Tunnes Limited, the strategy in this respect is to remain unique in the products offered on the global scale and adjust to the intended market for each product as well as focusing on the patent and protecting crops in a cost-effective way. Haygrove, a farming company and designer of field-scale poly tunnels, exemplifies this shift. Initially driven by demands for higher-quality fruits, Haygrove's cost-effective poly tunnels have become instrumental in providing crop protection solutions.

The shift towards natural plant protection

The roundtable experts discussed product growth and how to ensure plant protection and sourcing against operational costs.

For Ernest Myburgh from South Africa, Head of Natural Plant Protection for Africa at UPL, consumer demands are steering a significant shift in the industry. Traditional chemical companies are now heavily investing in innovative, all-natural plant protection solutions such as bio-stimulants, bio-fungicides and bio-insecticides. This move, echoing a broader trend across Africa, is supported by governments adopting sustainable technologies, marking a departure from past practices. ‘Financially, we're committed to this change, aiming to increase revenue in Africa from sustainable products to 15 percent by 2030 through strategic research projects, new product development, and acquisitions,’ says Ernest Myburgh.

‘Protecting crops not only ensures their safety but also leads to benefits like reduced chemical usage, making these growing systems pivotal assets in the agricultural landscape,’ adds Pablo Vial.

‘The technological innovation that we see in a move towards services is prompting us to look at what kind of products are available. And what can we develop to make the pay-for-use kind of facilities available for farmers. I think that the biggest revolution is coming in the way that financing is done as well as the use of information and data that is gathered and what we actually do with that,’ Antois van der Westhuizen from South Africa, Managing Director at John Deere Financial, Africa and the Middle East.

Drone technology: Revolutionizing agrochemicals and irrigation

‘The integration of drone technology into agribusiness is ushering in a new era, particularly in China and the Asia Pacific region. Farmers are adopting innovative technologies such as drone applications, leading to a substantial reduction in pesticide usage and a boost in efficiency. This shift represents not only a technological advancement but also generates a new business model, known as Factory-to-Farmers (F to F). In this model, manufacturers start to develop specialized formulations tailored for drone applications and position drone application service providers as a crucial new distribution channel. This new model is changing the game in the agrochemical industry, benefiting both farmers and the environment,’ says Norman Wu from China, Commercial Vice-President at CAC Nantong Chemical Co. Ltd.

As per Marcus Tessler from Brazil, General Manager at Valmont Irrigation Latin America, drones are becoming indispensable in modern irrigation. Traditional center pivot irrigation systems, once used solely for water application, are now dispensing fertilizers and equipped with real-time cameras for field monitoring. This evolution extends beyond technological advancements to a shift in the business model, with companies transitioning from selling equipment to providing services and software solutions through a subscription-based model. ‘This change is driven by the need for greater sustainability, as the industry seeks to produce more with less water, fewer chemicals, and reduced energy consumption. This transformation is not limited to center pivot systems; it extends to the entire irrigation sector. While the shift is challenging, it's necessary and promising,’ adds Marcus Tessler.

For Dr. Siang Hee Tan from Singapore, Executive Director of CropLife Asia, more important is the regulatory environment that will allow deployment in Asia Pacific. While drone use is thriving in most of the region, ensuring regulatory alignment is crucial for deploying crop protection products. It is imperative that a robust, science-driven regulatory framework keeps pace with this advancing technology. ‘Our regional initiatives are committed to supporting governments in shaping this framework. Furthermore, our commitment extends to promoting responsible stewardship within the industry. We achieve this by developing comprehensive resources such as "Guidelines for UAV Operator Training and Certification Standards" and conducting stewardship training in collaboration with a diverse array of stakeholders.’

Tech-driven agriculture and innovative financing approaches

Major players like John Deere are undergoing a significant transformation, transitioning from manufacturing to tech-oriented enterprises. The emphasis on service delivery, particularly pay-for-use models, is reshaping the financing landscape. Integrating technology like drones into financing solutions and leveraging data collected by advanced machines allows proactive risk management, a departure from traditional reactive financing methods.

‘We are actively exploring innovative ways to link service delivery to financing products. One example involves enabling customers to activate services while working in the field, seamlessly connecting these services to a financing product for convenient payment,’ according to Antois van der Westhuizen.

As the agribusiness landscape evolves, so does the need to adjust focus in talent management and acquisition. ‘Some of the most innovative people in their business are data wranglers who take all this big data the current technology provides and make sense of it. So, the requirements sought for somebody making a career decision are very different. The mindset is not about analysing balance sheets but about analysing risk and looking at ways of managing that risk and using people like data wranglers and salespeople at ground and technology available through third-party or partner companies,’ adds Antois van der Westhuizen.

In the startup arena, Grassa's innovative approach to extracting nutrients from grass, a seemingly abundant biomass, opens new avenues for sustainable food production. Grassa's process not only increases the nutritional value of grass but also diversifies dairy farmers into plant-based protein producers. While current financing landscapes heavily prioritize data, there is a need to balance this focus with investments in capital-intensive projects that can significantly impact sustainability. Rieks Smook from The Netherlands, CEO, Grassa, comments: ‘The focus should be on making more efficient use of limited resources. Innovations that enhance resource efficiency are paramount, especially in a world where fossil resources are depleting rapidly. Transforming waste into food is one such innovation, and our endeavor contributes to this cause.’

For Rieks Smook government regulation is one where knowledge is not good enough to go along with all the technology on offer, but another significant aspect continues to be the established way of doing things. ‘The established companies that have earnings models based on the abundance of fossil fuels, in addition to the fact that we can transport anything around the globe for very low prices, they are very often obstructing innovations because they tone on their earnings.’

‘The established companies that have earnings models based on the abundance of fossil fuels, in addition to the fact that we can transport anything around the globe for very low prices, they are very often obstructing innovations because they tone on their earnings.’

Barriers to innovation: Regulatory challenges and intellectual property rights

Despite the rapid pace of innovation, barriers persist, hindering widespread adoption. The global acceptance of plant breeding innovation, exemplified by the S DN 1 mutation, varies across regions. While some countries like India are making remarkable progress, others remain skeptical, creating a non-uniform landscape. Regulatory challenges, as seen in Africa's intricate landscape for biological pesticides, pose significant hurdles to the market introduction of eco-friendly alternatives. ‘CropLife's work aligns with the shifting global mindset that increasingly recognizes the significance of plant breeding innovation in agriculture, enabling the efficient integration of new technologies for a more innovative and progressive agricultural sector,’ says Dr. Siangh Hee Tan.

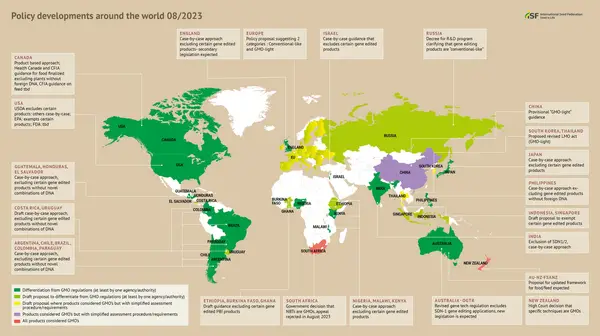

Dr. Siangh Hee Tan, Executive Director of CropLife Asia: Policy developments around the world 08/2023

Dr. Siangh Hee Tan, Executive Director of CropLife Asia: Policy developments around the world 08/2023

Europe adopts a more conservative stance toward agricultural changes compared to other regions and this conservatism potentially shapes the global trajectory of agricultural innovation. This inquiry gains relevance in light of the recent EU Commission approval, signaling a significant policy shift with the banning of more products and a 50% reduction in crop protection, indicating a potential transformation of Europe into a more closed market.

‘As a global technology provider, we observe concerns about the impact on global food security, as Europe, driven by the EU Green Deal and Farm to Fork strategy, extends its regulatory influence to developing countries, including Africa. This regulatory shift affects bilateral and multilateral trade, restricting the use of certain products in incoming countries. The consequence is a rapid reduction in available products and tools for farmers in smaller nations. The upcoming Asia meeting will address the potential impact of the EU Green Deal on future trade between Asia and the EU. Furthermore, a motion preventing the manufacturing of products not registered in the EU within its borders may lead to the relocation of manufacturing facilities from EU-related countries,’ adds Dr. Siang Hee Tan.

Per Ernest Myburgh, the biggest constraint for the commercialization of natural plant protection products, currently is the regulatory environment: 'Each country in Africa approaches the registration process differently and some are struggling to make the shift from registering conventional products to registering natural products. Currently, in a country like South Africa, biological products follows the same registration process as conventional products, which is a very long and expensive process. What we are seeing is a gap opening up between conventional products being withdrawn from the market and the new sustainable products coming to the market. For the export markets in particular, this is becoming a great risk.'

‘Small players face unique challenges in a world dominated by industry giants. Government regulations struggle to keep up with technological advancements and established companies resist change that may impact their profits. Overcoming these challenges requires raising awareness, incentivizing companies and striking a balance between internal development and collaboration with smaller tech firms. Intellectual property rights also emerge as a significant global barrier, with the need for open and respectful negotiations to foster innovation,’ adds Rieks Smook.

Conclusion

Innovation was at the forefront of our panel, in terms of both strategy and sustainability of what is currently in place in terms of resources and processes. All panelists agreed on the need for prioritisation of innovation and moving away from the traditional way of thinking as well as the value of collaboration, particularly among big and small companies alike.