Recruitment in 2015 - Energy and Infrastructure

The research covered engineering and construction firms (including consulting, EPC/EPCC) across all large energy and infrastructure sectors in South East Asia, and various segments, from developers to owners (operating companies). Data was based on advertised positions on numerous platforms, contribution from Kestria partners in South East Asia and also research reports by energy agencies in the various countries.

Overview of the Industry

There are exciting times ahead in Asia, with the focus moving to green energy from oil & gas, which has taken a beating due to low oil prices.

Philippines and Indonesian authorities have already indicated a desperate need for increased power generation in the coming years. Reports state that the Mindanao Island and Luzon have faced outages due to power shortage, and this can't continue for long, as the government puts in tremendous effort to grow the economy and accommodate the move from an agriculture-based economy to industrial economy within the next few years. The Philippines Government has also launched The Energy Roadmap as energy requirements are expected to go by 60 percent by 2030, and investments are encouraged in a) generation b) setting up high capacity interconnectors between different part of the Philippines.

Indonesia requires 35000 MW power in the next two years and several key players are investing in local offices and operations and early starters, have already put in place business development and sales teams to tap into key decision makers, to start identifying opportunities and influence the process.

Companies in Singapore are putting on hold any hiring unless it is business critical, due to a series of M&A activities driven by companies in the United States which are on a buying spree. The infrastructure industry has been growing steadily in Singapore, predominately driven by the government MRT projects plus commercial developments. However, commercial / residential development projects are declining as there is an anticipated over supply in 2016 /17. Many companies are looking into projects in Vietnam, Cambodia, Myanmar and India to expand their business or project development. Even the government's Design and Build housing projects are also slowing down. The next biggest project will be the Changi Airport Terminal 5 which is going to be larger than Terminal 3; the biggest government project in history. Big players in Singapore have submitted their bids and we are all waiting to see who gets it. There will be a surge in demand once the tender is being awarded.

The other excitement in Singapore, is the water desalination plants that the government is planning to build to increase water independence.

In Malaysia, there is so much of buzz of opportunities and activities created by Petronas' RAPID project located in Johore, south of Malaysia. Petronas is developing a refinery and petrochemical integrated development project and associated facilities in Pengerang, located in southern tip of Johor. Valued at about RM 115 billion (USD 27 billion), this mega-project involves joint cooperation by various international firms, including EPCC contractors. The complex will cover an area of 2,000ha and will produce nine million tons of petroleum products and 4.5 million tons of petrochemicals a year. The project will help Petronas to produce premium petroleum products and specialty chemicals. Demand for such high-value products is increasing, especially in the Asia Pacific region. The RAPID project will enable Petronas to meet this demand for the next 20 years. It will include LNG terminals, 1.22 Gigawatt Co-generation plant complex, chemical plants including a polypropylene plant.

On the back of an increasing demand for energy in Thailand, the Thai government was the first country in SEA to encourage alternative energy investment. The 10-year Alternative Energy Development Plan (2012-2021) aims to increase alternative energy consumption. This runs in parallel to construction of new power plants and extension of current plants in the country. Besides energy, other infrastructure projects that are being developed are new rail transportation projects and extension of existing railway lines.

Vietnam, Cambodia and Laos are planning for more hydropower plants, benefitting from the lower Mekong River that's a great source for the hydro plants.

Executives from the oil & gas who are affected by the slowdown have begun exploring opportunities in the renewable energy sector.

Overview of Recruitment

An overall review of positions actively recruited by companies in the engineering & construction sector (including consulting firms, EPC/EPCC) reveals a focus in the area of construction and operation phase of projects. This could also be because most contracts that were dished out between 2013-2015 are gradually coming online. Some have matured into construction phase, at this time. There seems to be lesser hiring for design/development stage due to softening of market generally and companies are using the opportunity to carefully review and deploy current talents. Besides the mainstream hiring, there were sizeable hiring in the support side of the business, in HR, Communications and Finance (transactions/operations).

Companies actively recruited for power projects (focused in Combined-Cycle, Cogeneration and Geothermal plants - green field and also extension projects), water projects, LNG and refinery, besides port and railway in countries like Singapore, Indonesia, Philippines, Thailand and Malaysia. Some companies act as center of competence and execute projects in Europe and Middle East, mainly railway and transport management systems.

There is a “war for talent” in this sector because the Philippines need to do a lot of catching up where energy and infrastructure are concerned. As there are also new companies setting up in Philippines, there will be a need for both, commercial and technical experts, from HR to Projects. For 2015, the focus seemed to be on ramping up renewable energy projects (hydro, solar, wind and geothermal).

We expect increased recruitment for management positions and business development focused positions for entrepreneurial companies going into General manager level positions for entrepreneurial companies going into the marketing of solar energy for commercial establishments in the Philippines.

Many of the Philippine-owned conglomerates have or are going into energy so there were new companies established and hence, searches for HR, Finance, IT executives.

Interestingly, some Philippine-based companies like First Gen are leveraging on competencies in renewables to invest in South America. They initially will bring top level executives with them abroad and then hire locally for the technical positions. The Philippines has one of the highest percentage rates of renewable energy sources at about 30 percent.

The energy and infrastructure sector in Thailand is dependent on expatriates from the region besides Europe and the United States. Language and skills remain as the main problem in Thailand, especially in specialized fields where these are critical.

Across South East Asia, there was extensive hiring in project management, commercial management and construction management. Companies recruited Project Director and Project Managers, QA/QC, HSE, Site Manager, Construction Manager and Contracts Managers, among the leadership positions, and a larger number of hiring at the mid-level such as Engineers in various disciplines, overseeing the construction activities. Companies are more savvy after numerous contracts that went into arbitration in early 2000s in SEA, and have hired Contracts Managers with legal background who look into legal and risk management in pre- and post-contract stages.

Hard to Fill Positions

Among the hard to fill positions are Project Director, Contracts Manager, Legal Manager and specialists in the various sectors. Companies require Project Directors who have vast experience in managing large complex projects whilst most candidates have a mix of projects, from small water projects to small power and refinery, or they may not have had sufficient project leadership experience covering multiple projects. Engineers experienced in installation and commissioning, especially in mining, were hard to find. Geodetic/mining engineers are in short supply because there are not so many graduates of such specialization. In the Philippines, engineers working abroad were lured back to consider these positions.

Clients also require Contracts Managers with experience in claims and dispute management, and ideally possessing an additional law degree. Legal Managers in projects need to play a "business partnering" role than going by the books. The Legal Managers should have experience identifying at early stage of proposal, legal and risk matters and manage through until completion of projects.

Other positions that are hard to fill are more specific in the area of engineering, such as geotechnical and structural but this is mainly due to most talents being occupied with ongoing projects.

Recruitment Challenges

In recent years, due to unrelenting vacancies and "almost immediate" demands for technical experts, there have been extensive poaching of employees as a quick fix by these organizations. What transpires after few years is that most engineers come out with high salaries, but lack the depths in specific expertise, especially when they move every year or so. Poaching also troubles the current employer who is also most times unprepared in the event of resignation of key employees.

Besides the above, candidates are now much more demanding in terms of salaries, benefits and working conditions.

A plethora of vacancies that come about due to business growth and expansions, much quicker than the ability of the recruitment team in filling these vacancies, pose a huge problem to the organization. Unlike other sectors, manpower planning is always tricky in projects-based energy and infrastructure sector. Internal recruitment teams are stretched trying to meet deadlines in filling these positions and the paperwork for hiring, that some times they overlook key processes especially reference checks.

Time to hire also causes companies to loose good talents. Misalignment of requirements between stakeholders and hiring managers, misplaced priorities, lacking transparencies in process and communication, and slow decision making, are holding critical recruitment back. Companies have lost good candidates to competitors and also risk diluting the reputation of the company as a global employer of choice. Discerning candidates measure employer branding not just by what they hear or read, but their own personal experience during engagement with the various key people in the organization.

Other challenges in recruitment are, lack of a complete employee on-boarding, especially in the first 6 months of joining. Some view on-boarding as merely orientation. As project delivery takes priority, most times, the people hired are brought immediately into the system and start working on projects. Induction trainings are carried merely to fulfill formal processes. Important phases of on-boarding especially in project-based organizations are introduction to key stakeholders in the projects, formal briefing session of project background, progress, etc and key issues to tackle.

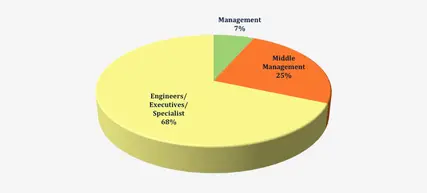

Recruitment by Position Level 2015

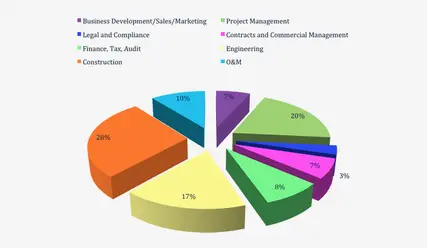

Recruitment by Function 2015

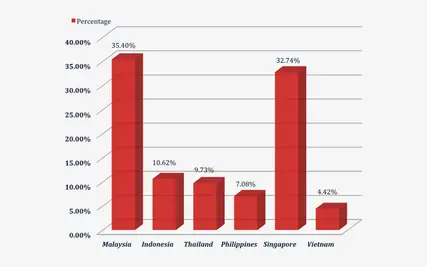

Recruitment by Country 2015

Using the Lull Period to Gear for a Recovering Market

We noted amongst our own clients and competitors, an increase in recruitment for Business Development/Sales functions. These companies are focusing on driving growth in the oil & gas sector (downstream), renewable energy and industrial plants. They are also focusing on greater penetration into existing verticals or across sectors. The typical pattern during recession or market softening is to move into plant extensions, refurbishment or operations & maintenance.

In terms of hiring, what seems to be emphasized now, is the quality of your network and strength of relationship, understanding the business development tactics in each sub-segment and also the bidding process with each company.

There are clients that see an increased interest in renewable energy and have begun putting in place sales and proposal development teams and integration or technology partners. These companies are increasing business development to explore further in the agriculture, wood/timber and plantation, and other industries that provide rich feed for renewable energy.

What's in store in 2016

We anticipate a wait-and-see approach at least till Q2 2016 as various reports suggest that the market will start seeing positive signs from 2017. Some believe the worst is yet to come, and some are experiencing it now. We also believe that some companies are using this situation to consolidate, reassess and redeploy people in and across business and regions. There seems to be focus on people development and locals are being sent to other regions, than they traditional practice of bringing expatriates over.

Shift from International Expats to Regional Expats

External hiring seems to be shifting from International Expats to Regional Expats, vis-à-vis the strategy localization, reducing expatriate costs, and developing local talents. However, we also noticed that clients who do so with ultimate goal significant cost-savings, compromise on other traits, ending up with mediocre quality of leaders.

In the last 10 years, many Asians have moved to the western markets and have become PR or long-term expatriates in these countries. Their salary levels are much higher than what it used to be. Some enjoy tax benefits besides housing and transportation allowances. When they are offered opportunities in this region, these expats are not willing to part with the benefits or agree to salary adjustments based on local practice. Others who have personal motivation or reasons to return, expect at least a premium to the salary paid to the locals, minus the extensive perks and benefits such as international schooling, premium housing, etc.

Clients who are more willing to pay premium to local or regional talents, have greatly benefited from the practice as these talents come ready with expertise at global level, possess international mindset, easily adapt to the culture and most importantly able to seamlessly interact with all counterparts of various nationalities and background. The clients are more interested in increasing diversity and do not mind gaining marginal savings, as they want to also ensure less chaos during the transition.

Interestingly, few clients have only now seen greater value in manpower planning, in especially the energy sector. In the past, the business is used to swinging into action fast and often fire-fighting with focus on successful commissioning of projects and meeting agreed deadlines. This resulted in excess of engineers/employees, mismatched skills and under-utilized talents or talents with greater potential. Companies are using this slowdown to right-size and redeploy people into other projects with critical needs. External hiring is done only if the expertise is not available internally.